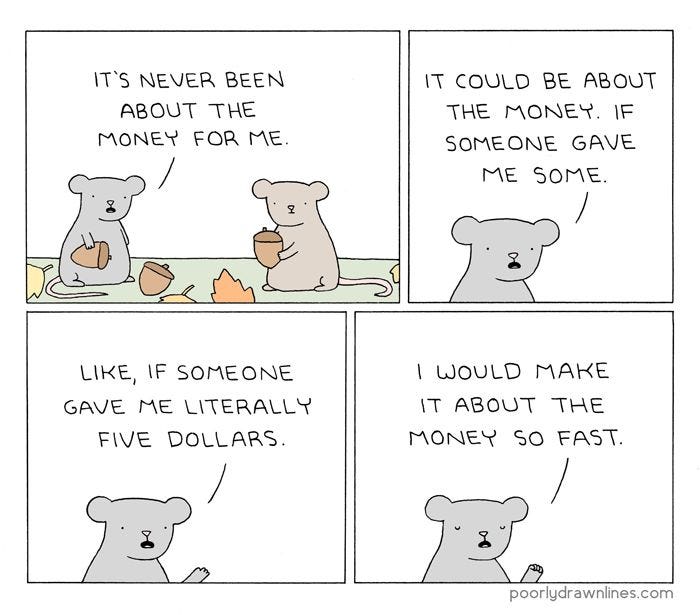

The (not-so) little lies we tell ourselves about money

The stories we tell ourselves to feel in control.

Money has a way of showing you things about yourself you’d rather not see.

Just yesterday, for example, I put $6,500 at risk to make… $15.

Technically a win. More realistically, a reminder of how easy it is to confuse motion with progress and risk with intention.

I’ve seen this pattern before.

How responsible I think I’m being. How greed sneaks in disguised as confidence. How the fear of losing money never quite goes away. And how much I enjoy the thrill of the move, even while insisting I don’t gamble.

You don’t need to invest, trade or take financial risks to recognize this feeling. It shows up anywhere money is involved.

It shows up when we justify a purchase we said we wouldn’t make, avoid checking a balance or promise ourselves we’ll “get serious next month.”

Money doesn’t just track what we earn and spend; it exposes our habits, our fears and the stories we tell to stay comfortable. And those stories — small, reasonable and often well-intentioned — are the lies we rarely question.

Most of us like to believe we’re being honest about our finances: responsible, realistic, totally in control. But the truth? We tell ourselves small, soothing stories about money all the time.

Life’s rough enough. So we smooth the edges. We reframe. We delay reality just long enough to get through the month.

The problem isn’t that we tell these lies, it’s that we believe them. And believing them can quietly sabotage our financial health while we’re busy insisting everything is fine.

I’ve been there, and so have you. These lies feel harmless, comforting even — until they’re not.

Here are five of the most common ones.

Lie #1: “I’m rational with money.”

We want to believe we’re logical adults. But money decisions are emotional first, rational second. Fear, ego, boredom and optimism are all significant factors in our decision-making, whether we admit it or not.

Lie #2: “This doesn’t really count because it’s a one-time thing.”

One-time expenses have a funny way of happening every month. Trips, treats, emergencies. Ignoring them doesn’t make them disappear.

Lie #3: “I deserve this.”

Sometimes you do. Sometimes you just want it. Using “deserve” as a spending strategy blurs the line between self-care and self-sabotage. Your bank account knows the difference.

Lie #4: “I’ll start being serious about money when I make more.”

This is the classic deferral tactic. More income feels like the solution, but habits — not paychecks — win in this race. If money leaks now, it’ll leak later — just faster.

Lie #5: “I basically know where my money goes.”

Knowing in theory isn’t the same as knowing in detail. The gap between the two is where budgets quietly go to die.

Lie #6: “Future me will figure it out.”

Future you is not a wizard. They have the same job, the same bills but less time and energy. Pushing problems forward never solves them.

Money doesn’t lie, and it doesn’t forgive the stories we tell ourselves. It quietly tests every decision, every excuse, every fear, every habit.

The question isn’t whether we’ll make mistakes. It’s whether we notice them, take stock and actually do something different next time. That means paying attention, calling out our impulses and being honest about what we’re really doing with our money.

An adjustment here, a smarter choice there, and over time, those tiny acts add up.

Before we know it, we’re not just hoping for control. We’re seizing it.

I've never tracked my spending. Instead, I (would) put aside a percentage of my pay before spending anything. I wrote "would" because I retired in 2024.

Whatever is left after saving is available to spend as I and my wife decide. Much simpler.