The dark side of trading

High stakes. Hidden risks. Harsh realities.

Labor Day weekend wasn’t just a holiday for me. It was a hard reality check, the moment I finally faced the truth.

I’m an addict.

Not to alcohol. Not to drugs. But to trading.

To the rush. The risk. The reward.

I used to think I was just passionate. Obsessed, even, but in a productive way. I told myself I was “committed to the craft.” That this was discipline. Ambition. What separates winners from losers.

But here’s the truth no one tells you.

The risk isn’t just that you could lose money. The bigger danger is losing yourself.

That realization didn’t come from a blown account or a brutal loss. It came from something way more unexpected.

I was watching one of those AI-generated YouTube videos. I’m a sucker for them, honestly. Sure, they’re artificial, but they hit home. They’re motivational and educational.

This one was titled, “The Dark Side of Trading Psychology: Self-Sabotage Explained.”

I clicked it without thinking. A few minutes in, I realized the clunky, computer-generated voice wasn’t just talking about traders. It was talking about me.

And then, at the 22-minute mark, it cut deep.

“What if success isn’t the only thing sabotaging you? What if you’re not trading for money at all, but for the high? They say trading is a skill, a business, a profession, a path to financial freedom. But for most people, trading is something else entirely. A drug. Not metaphorically. Biologically. Neurologically. Literally.”

I sat there frozen.

“Dopamine is the molecule of motivation, desire and pursuit. Not pleasure. Anticipation. It fires not when you get the reward, but when your brain thinks a reward might be coming. You know what triggers dopamine the most? Uncertainty. And you know what’s the most uncertainty filled activity on earth? Trading. Every time you place a trade, win, lose or break even, you’re feeding your brain the same variable reward system used by casinos, slot machines and social media platforms.”

The message tracked almost perfectly with the lessons I’d been learning from “Trading in the Zone” by Mark Douglas: Stay disciplined. Control your emotions. Stick to your system.

But this video took it further. It peeled back the mask.

It included a story about a married man, sabotaging sleep, glued to the charts in bed at 3 a.m., endlessly scanning for setups.

It was all too familiar.

“The charts were more real than reality,” the voice continued. “Candlesticks became my language. Tickers became my comfort zone. The market became my only relationship that made sense. Not because I loved it, but because I was using it.”

Then came the final gut punch.

“We don’t talk about this in trading communities because we like to dress it up. We call it passion. We call it hustle. We call it being dedicated to the craft. But let’s call it what it really is — addiction in a suit. Gambling wrapped in spreadsheets. A dopamine loop we mistake for purpose.”

That’s when it hit me.

I haven’t just been trading for freedom. I’ve been trading to feel alive.

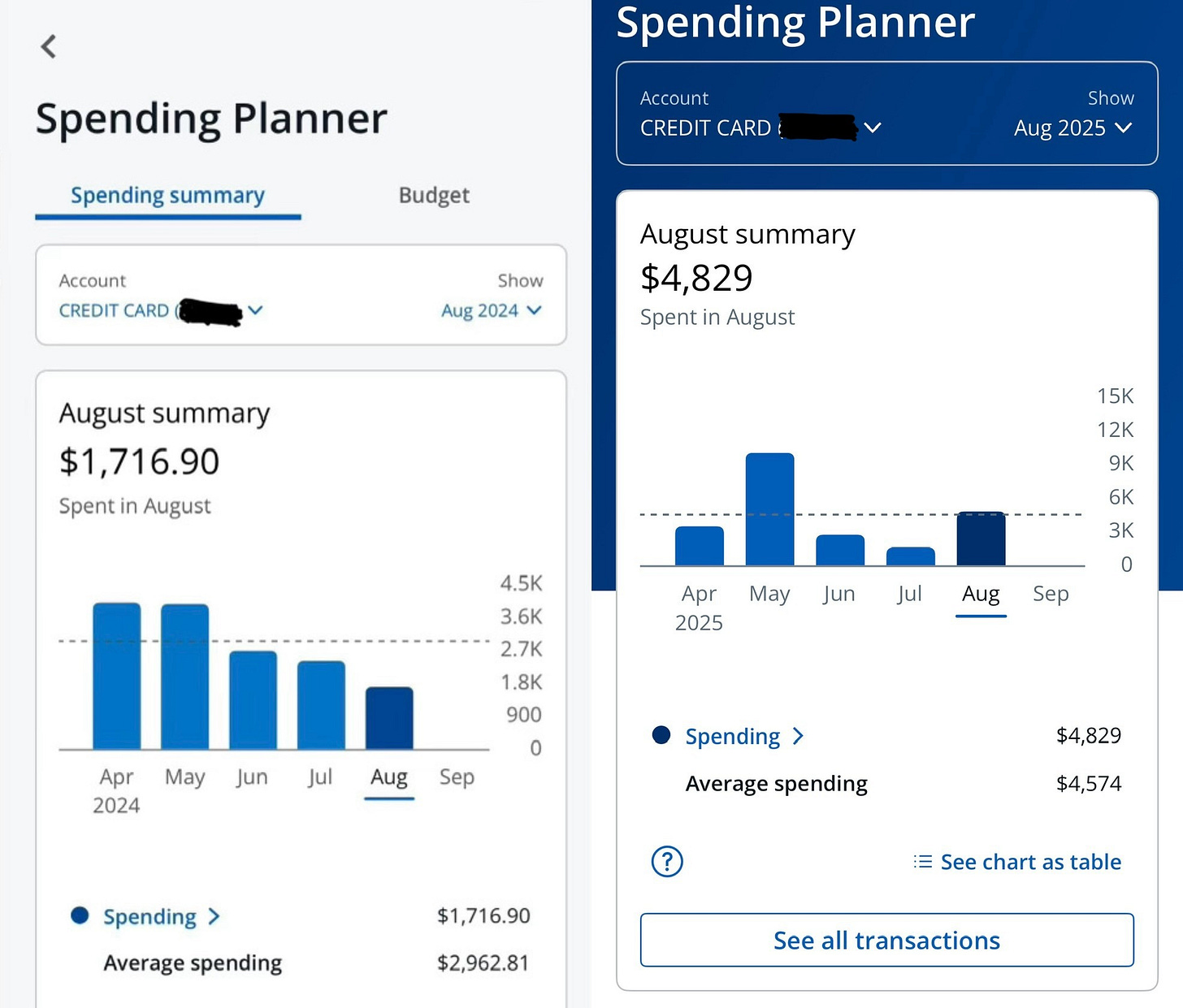

I did little else outside of watching charts and placing trades in August, even though my $4,800 credit card statement doesn’t reflect just how deep into the rabbit hole I am.

Looking back, August should have been a blur of beach days, barbecues and time spent unplugged. But the truth is, I was glued to my screens, chasing setups, scanning headlines, refreshing tickers like my life depended on it.

I made more than 300 trades in August. Way too many.

But it’s my version of on-the-job training. And I’m too focused to spend time — or money — elsewhere.

And yet, if you looked at my credit card statement, you’d think I’d been out enjoying life. In reality, I barely left my apartment.

Online shopping for a few long-overdue essentials, combined with another round of vehicle repairs, helped spike my bill. They accounted for $2,675, or 55 percent of my August spending.

The numbers paint one picture. Reality shows another.

My real cost in August wasn’t on my credit card statement. It was in the hours I lost, the sleep I skipped, the rules I broke, the trades I chased.

I wish I could say the video changed everything. That I closed all my positions, deleted my apps and finally got some sleep. But that’s not how this works.

Addiction doesn’t end with awareness. It begins there.

What that video gave me wasn’t closure but a mirror. And now that I’ve seen what’s really staring back at me, I can’t unsee it.

I still trade. I still chase. I still tell myself I’m learning.

But now, every time I plow through a guardrail to take a trade I shouldn’t, I hear that AI-generated voice in the back of my mind:

Addiction in a suit. Gambling wrapped in spreadsheets. A dopamine loop I mistook for purpose.

It doesn’t stop me.

But at least now I know what I’m up against.

Seems like you're waving away red flag after red flag in your pursuit of this option strategy. I just hope you have guardrails in place and this is a small (10% or less) portion of your overall portfolio.

I have yet to start options trading. I’m more risk averse but may dabble a bit. I do see it is a way to supercharge your investment journey. But I’m also scared of losses.