The anatomy of a blown account

How I torched my first trading account — and learned the hard way.

Everybody talks about the wins. The big scores, the fast money, the illusion that it all comes easy.

But the losses? Those get buried. Quietly. No screenshots. No stories. Just silence while accounts bleed out.

At Money Talks, we don’t do that.

Last week, I torched my first options account.

For nearly a year, I poured time, energy and hope into this. Every trade felt like a step closer to cracking the code. Until it all unraveled.

It wasn’t just money lost — it was 12 months of my late nights, stubborn effort and every shred of my confidence burning away in real time.

It was a harsh lesson and a brutal reminder of the severe risks options trading carries. I had been warned.

“Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses,” the disclosure from TD Ameritrade read — the only sentence bolded on the page.

They say it happens to everyone at least once. That may be true, but when it’s your account, your capital and your emotions, nothing can prepare you for staring at a sea of red.

It’s the crushing weight of every mistake, every bad call, every reckless double-down fueled by hope rather than strategy.

Step into this arena, and you quickly realize trading is as much a battle of mind and nerves as it is numbers.

My first ride lasted just shy of a year.

I pulled the plug last Wednesday.

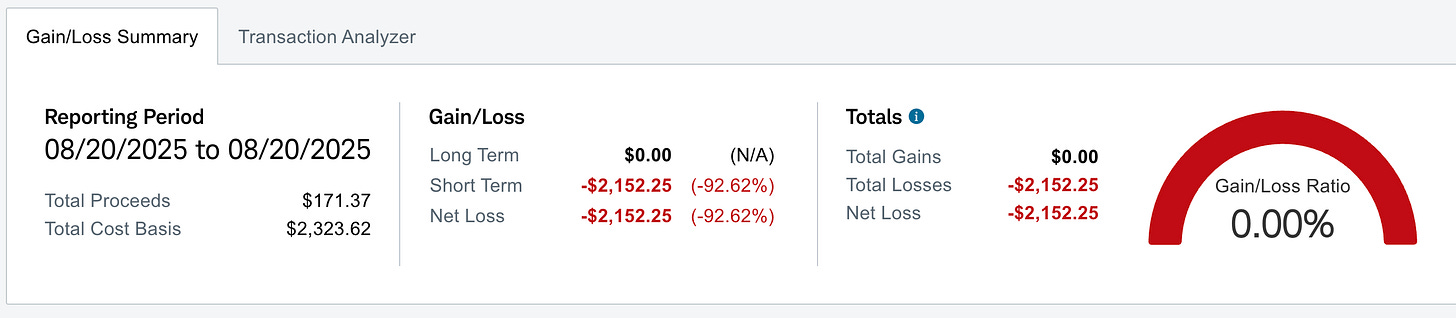

I funded the account with $2,500 in August last year, and when I finally conceded defeat, I was left with less than $200.

But I’m not quitting.

The numbers are ugly, but I’m already building it back, brick by brick.

More importantly, the lessons are clear.

I blew my account by doing everything I knew I shouldn’t. Oversized trades. No risk management. Chasing losses. Trading without a plan.

It wasn’t just bad luck. It was bad habits.

With my final four positions all down by at least 90 percent, I lit the match — closing out and walking away with $175 and a hard-earned education.

This game requires more than luck and YouTube videos. It demands structure, discipline, patience and repetition. Then you need guidance, support and accountability.

I thought I could do it alone. I couldn’t.

This time, I’m not walking alone. I joined a trading community founded by Aristotle Investments, a young trader and serial entrepreneur I met at Invest Fest two years ago.

Through his subscription-based Honey Drip Network, Aristotle and his team offer live, real-time support for traders looking to sharpen their skills, build consistency and trade with confidence.

I pay $125 a month to be part of his group.

Sure, it’s steep, but if that number gives you sticker shock, you wouldn’t believe the value on the other side.

Behind the paywall, you get real tools: curated morning watchlists, live pre-market Zoom calls, access to options flow scanners showing what institutional money is doing and live trading with the pros.

You don’t just earn — you learn.

Of all the value offered, the best part might be the community, now more than 10,000 strong.

When the admins aren’t sharing tools, tips and strategies, my fellow traders are. It feels like one big virtual college campus; part classroom, part community.

In my first month with the group, I’ve turned a profit. Not because I cracked the code or got lucky, but because I’m finally getting the mentorship I needed.

I’m done learning the hard way.

It took blowing my first account to accept that I needed help.

Now that I’ve got it, I’m back in the game.

I dunno, Darnell. I don’t know any professionals who recommend options trading - other than the ones making money convincing others it’s a good idea. As a hobby or a way to learn the market, it’s an expensive one. But if the goal is long-term investing, that is a lot of risk that could keep you from reaching those goals.

Options are one of the many things on the list of complicated things that I don't want to touch. Everything in VT and index based target date funds for us. All I want to do is throw more money into my accounts and let it grow.

It seems like you've done your research and are well aware of the potential pitfalls, but it seems like you're taking on a ton of risk/effort. Quite a departure from the Simple Path to Wealth.