Inside my most expensive month ever

How I spent nearly $10,000 in May.

May was … a lot.

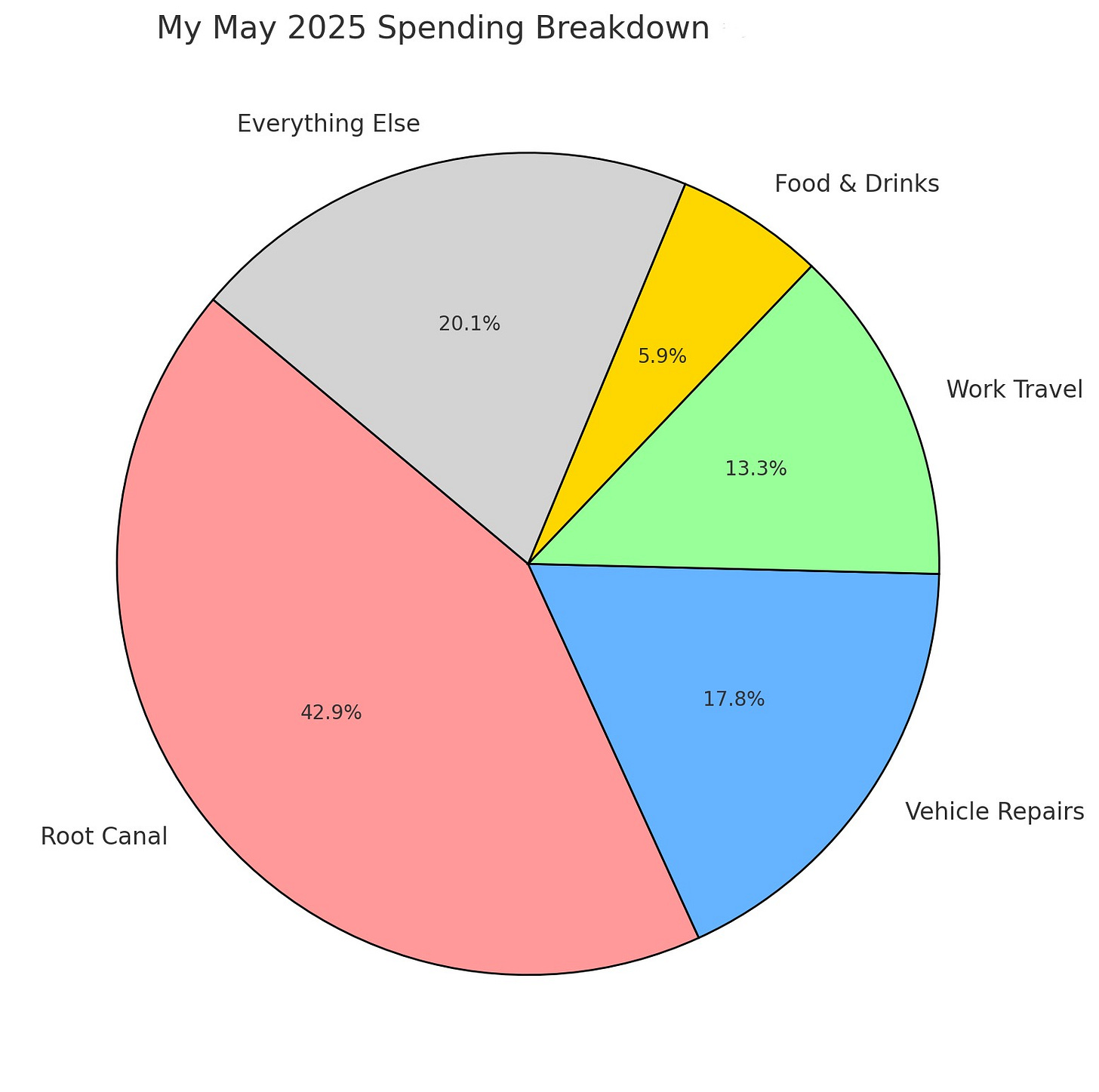

I spent $9,577 in total — my highest monthly amount ever — and honestly, when I looked back at the numbers, I wasn’t even surprised.

Two big-ticket items blew up my budget, but as I do each month, I’m breaking down the details here for transparency, accountability and to help normalize what real-life spending actually looks like.

I make the majority of my purchases with a credit card so I can accrue airline points to fly for free. A few mainstays are excluded, such as rent, gas for my apartment and vehicle, my electricity bill and my $10 monthly gym membership.

With most of my expenses on my credit card, it serves as the best tool for monitoring my spending, and each month I share my progress, for better and worse.

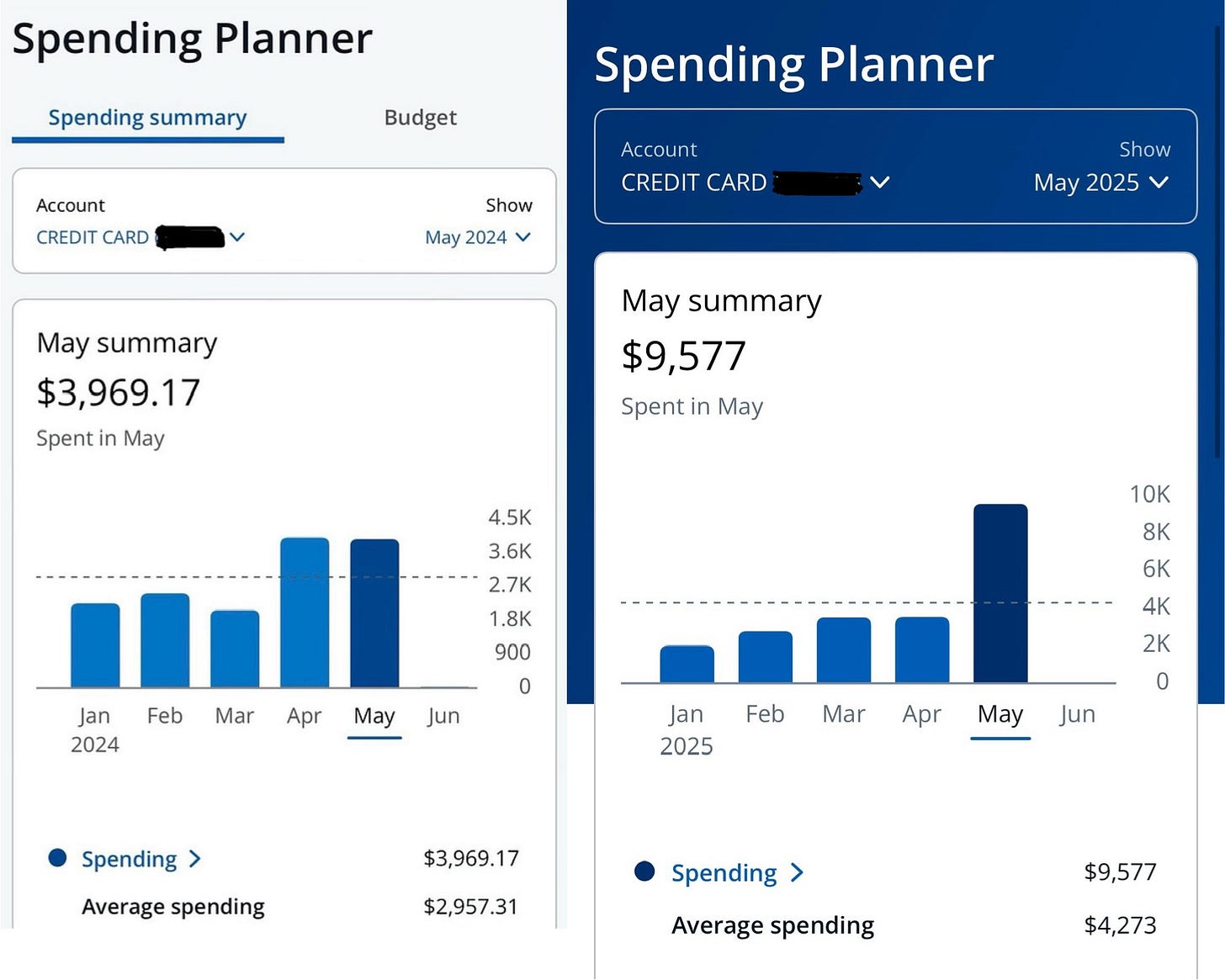

🔁 May 2025 vs. May 2024

My spending was way up from last May, but the “why” matters more than the total. Still, the number’s an eyesore.

I spent $5,607 more in May 2025 than I did in May 2024.

My budget — a lofty annual $25,000 spending goal that means keeping monthly spending under $2,083 — never stood a chance.

Let’s dive into the particulars.

🦷 $4,111 – Root canal

This was an unexpected hit, but I handled it well thanks to my growing financial resilience.

Yes, it was as painful — more emotionally than physically.

I paid for my treatment out of pocket but plan to get reimbursed through my health savings account.

Again, I’m grateful I had a freedom fund for moments like this.

And after all the pain, I’m just glad I can chew again!

🚗 $1,704.19 – Vehicle repairs

My car was overdue for maintenance.

With an upcoming road trip to Oklahoma, repairs could no longer wait. But between parts, labor, diagnostics, tax and service fees, the bill stacked up fast.

This wasn’t a “fun” expense. It never is. Remember, expensive vehicle repairs kicked off my journey to smarter money habits. It’s another reason I build a buffer into my budget.

✈️ $1,272.31 – Work travel

I had a few work trips in May. Hotels, rental cars, meals and rideshares. All of this has been reimbursed, but I still had to front the costs.

It’s a good reminder that even business travel can make personal finances feel tight temporarily — and if you’re not careful tracking expenses, it could get costly.

🍕 $561.58 – Food & drinks (No regrets)

This was my highest food-and-drink expense of the year. It might not sound like much, but for me, it’s unusual — $561 a month adds up to over $6,700 a year, more than a quarter of my target budget.

But honestly? I have no regrets. I ate everything: pizza, burgers, Chinese, Mediterranean, ribs, chicken wings, cookies, cupcakes, donuts… and funnel cake.

Was it a coping mechanism? Maybe.

Was it delicious? Absolutely.

Sometimes life hurts. And sometimes the cure is comfort food.

🧾 The rest: $1,927.92

After the big-ticket items, I spent just under $2,000 on essentials. That amount is more in line with my usual monthly spending.

Still, I made room for a few luxuries, which I’ll share more about next week.

But a major shift I’ve noticed is my grocery bill. It’s dwindling — thanks to my lady friend, Triest. She’s graciously assumed most of the grocery shopping and cooking duties.

At just $161.75, my grocery bill accounted for only 2% of my May spending. In April, my grocery category totaled just $121.03.

It’s been a quiet but meaningful shift — one that has lightened my budget and filled my belly.

🔮 Looking ahead: What I’m focusing on next

With almost half the year behind me, I’m re-centering on my financial goals:

💸 Rebuilding my emergency fund

💸 Planning ahead for other big expenses

💸 Watching food spending — not to deprive, but to stay conscious

💸 Continuing to track my money honestly, even when it’s messy

✍🏽 Final thoughts

I’ve learned that budgets aren’t about perfection but preparation.

May was messy, expensive and utterly exhaustive.

If your month felt like a financial roller coaster too, you’re not alone. Just remember, we don’t earn bonus points for flawless budgets, but we do get stronger financially when we face each month honestly.

Messy months build better money muscles.