Busy life, blurry finances

I took my eye off my money — and it shows!

In the middle of juggling everything else, I let my finances take a backseat.

Now it’s starting to show in small stresses, missed details and the creeping sense that I’m losing track and allowing money to slip through the cracks.

It’s understandable.

Life gets busy. Priorities shift. Survival mode doesn’t leave room for spreadsheets or budgeting apps. I know I’m not alone in this. Most people, at some point, find themselves caught in the current — struggling to stay afloat while the principles of financial management drift far out of reach.

But the longer I go without addressing my lapses, the harder it feels to get back on track. Not because it’s impossible, but because issues have piled and avoidance has started to weigh more than the actual work of fixing it.

Yet something unexpected has come out of this messiness.

In a way, it has grounded me, reminding me how difficult it can be to maintain financial awareness when life is at its most chaotic.

It’s easy to be diligent when things are calm and predictable. But managing money when everything else is loud and demanding? That’s the biggest challenge most of us face, and it’s why money matters often get pushed aside.

Fortunately, I’ve dedicated myself to a thorough accounting of my spending each month. Simply committing to writing this column keeps me in check, even when I want to stray from smart money moves or I don’t feel confident.

I make the majority of my purchases with a credit card so I can accrue airline points to fly for free. A few mainstays are excluded, such as rent, gas for my apartment and vehicle, my electricity bill and my $10 monthly gym membership. With most of my expenses on my credit card, it serves as the best tool for monitoring my spending, and each month I share my progress, for better and worse.

After life’s responsibilities snatched my focus in April, it’s up to me to get it back. No one is coming to rescue my budget or track my spending for me. I had to face the numbers, take ownership of my choices and start the process of regrouping.

As of this writing, my credit card balance is $6,387.38. That’s a staggering amount for me. Anything over $5,000 is a red flag that screams, “You’re spending too much!”

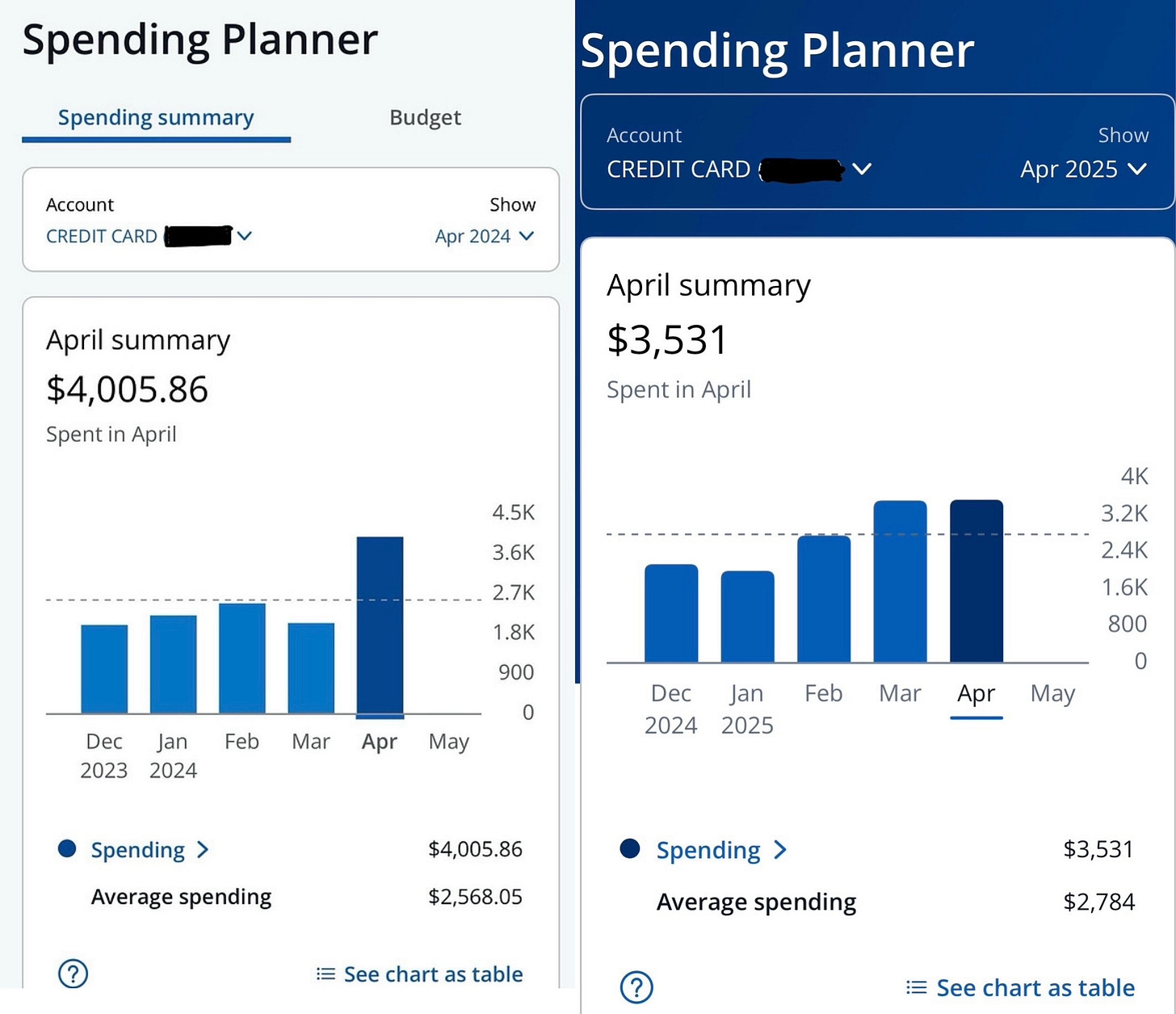

My $3,531 balance in April marked my highest for a single month this year and the most I’ve charged since May 2024.

The good news is that much of that total is tied to work travel: flights, hotels, rental cars and meals that will be reimbursed. Without those expenses, my balance would look very different. But seeing the full number in black and white was enough to jolt me out of my financial autopilot.

I spent $1,500 last month on work expenses, which put my personal spending at $2,000 in April, a figure that’s much closer to the neighborhood I like to live in.

An enchanting Disney World trip with Parker, paired with work travel to Oklahoma City and Memphis, to push things higher. I made it a point for us to soak up every bit of fun in Florida without thinking about the cost. Only after tallying my spending for this column did I realize I spent $282.59 on the final two days of our three-day, daddy-daughter getaway.

I also put down a $488.26 deposit for a surprise summer outing with the family. Filing my taxes through my go-to online service cost $313.92. And I paid an additional $189.56 out of pocket for food and drinks, outside of groceries.

Somewhere between all the travel and Disney magic, my usual diligence started to slip.

My vehicle registration expired in March. To renew it, I must pass an emissions test. But I can’t do that without replacing the faulty fuel filler neck — the same part I needed back in September. The problem? It’s still on national backorder.

So far, this has already cost me a $60 ticket, and every time I drive or park on a public street, I’m rolling the dice. I’ve also shelled out $39 for three separate, one-week temporary registrations, the maximum allowed in Illinois.

The replacement part alone will cost more than $700, and the overdue registration will run me over $150.

And to top it off, thanks to my current work — a return to Oklahoma City — I had to reschedule the first stage of treatment for a root canal. Yes, I’m still in pain!

In the span of 30 days, it feels like all my healthy money habits are crumbling down as the world around me closes in.

But maybe it’s not a collapse, just a necessary challenge. A test of whether I can maintain structure and focus, even when life feels relentless.

If you’ve lost track too, know this: it’s never too late to return to your money goals with clarity, with compassion and, most importantly, with a fresh start.

Money is like health, it is hard to always give it our full attention all the time but consistency in aggregate pays off. You reined it in fast and that is something to be celebrated.

I hear you Darnell. My system is to use a spreadsheet that I populate with downloaded transaction data. (Like you, I try to keep all my expenses on my credit card, which is a 2% rewards card offered by my bank. Then I can download bank and credit card transactions together.) I can always tell how vigilant I've been based on how many weeks have passed since the last download. The longer it's been, the harder it is to catch up. A vicious cycle. And figuring out the right way to think about those lumpy expenses like the tax filing charge, auto bills, and vacations is always tricky.

It's tough, but you're staying on top of it!