Scared money don't make none

Fear won't fund your future.

Every time I write about trading stock options, readers rush to warn me it’s a bad idea.

Not just risky. Irresponsible. Dangerous. A fast track to financial ruin.

They’re not wrong to be cautious. Options can be complex and volatile. But over and over again, I’ve learned their fear usually has less to do with options and more to do with money itself.

People aren’t really scared of options. They’re scared of losing. They’re scared of being wrong. Of doing something outside the boundaries of what feels "safe."

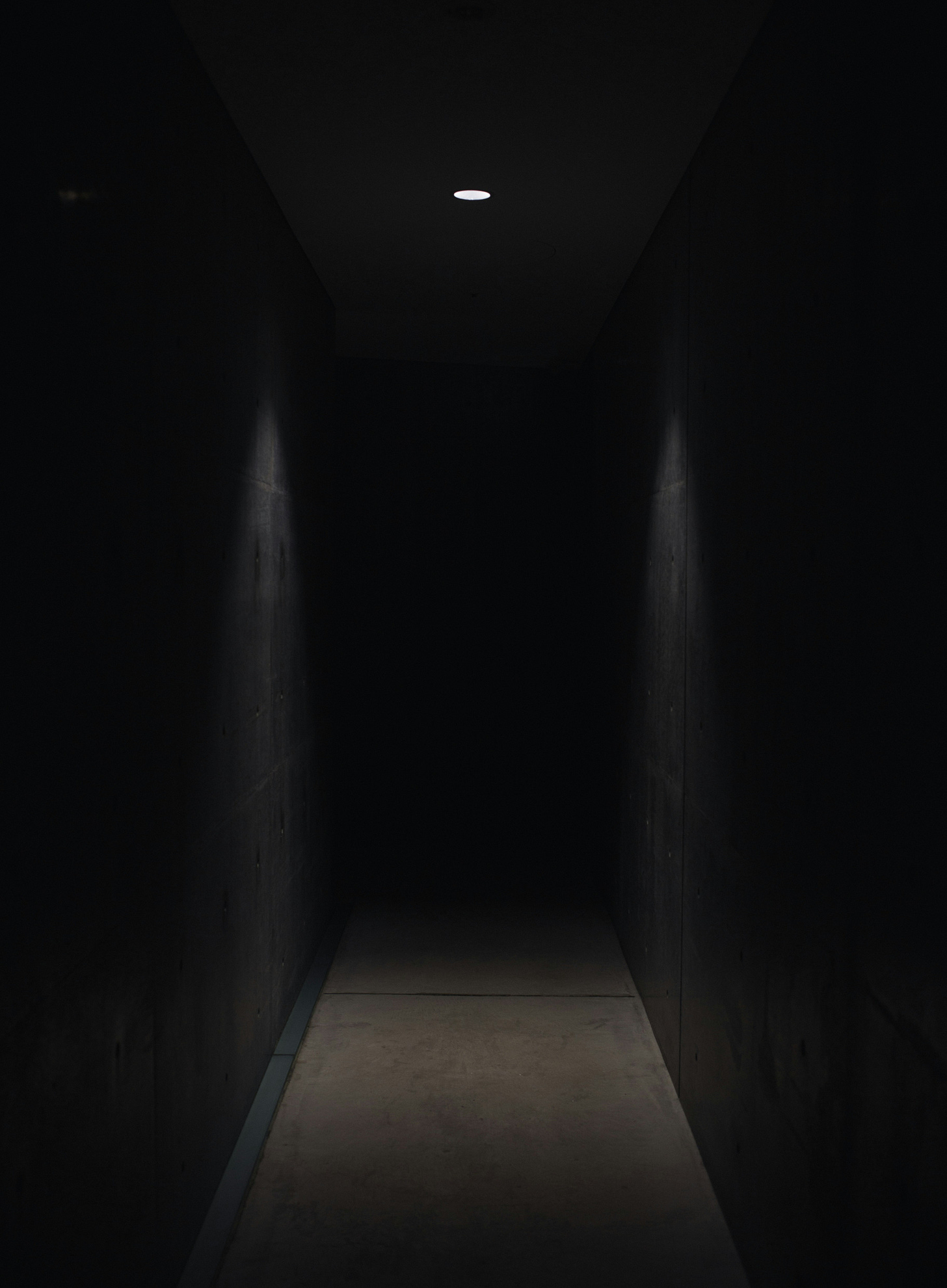

But here’s the truth: safe doesn’t build wealth.

It maintains comfort. It preserves what already exists.

Wealth — real, compounding, life-changing wealth — comes from taking calculated risks.

And that’s where people get stuck. I know because it’s been my comfort zone for most of my life.

For years, I thought I was being smart, responsible even, by avoiding anything that felt like a gamble. I saved diligently. I avoided debt. I stayed away from anything that looked too complex or too risky.

On the surface, I was doing everything right. But underneath, I wasn’t acting out of discipline. I was acting out of fear.

Fear of making a mistake.

Fear of losing money I couldn’t easily replace.

Fear that one wrong move would prove I wasn’t cut out for this.

That’s the thing about emotional attachment to money. It disguises itself as logic.

It sounds like: “I just don’t like risk.”

It sounds like: “I’d rather wait until I know more.”

It sounds like: “I’m just being cautious.”

But it’s not caution. It’s control. And control is the currency of fear.

It took me years to see that money wasn’t just a resource in my life but a symbol. Of safety. Of power. Of success.

And when you attach meaning to money, you stop treating it like a tool. You start treating it like a reflection of who you are. Which means every decision feels personal.

Every loss feels like failure. Every risk feels like a threat to your identity.

We’re not just managing finances. We’re managing fear. We’re managing pride, shame, security and ego.

Ironically, options trading reveals all of these traits within us.

The need for control. The discomfort with uncertainty. The urge to be right.

Trading options — or doing anything that stretches your financial risk tolerance — becomes an emotional audit in that way. It forces you to confront what you really believe about money. What you believe about yourself. What you're afraid to lose — and why.

You're not just putting money on the line. You're putting your beliefs on the line. Your confidence. Your trust. Your emotional conditioning. And most people are not ready for that.

Some people avoid investing not because they lack information but because they fear what making a bold move might say about them if it doesn’t work out.

Others avoid complexity because they’ve equated confusion with danger. And many, maybe even most, simply avoid discomfort altogether.

But there’s a universal relationship between risk and reward.

You don’t get one without the other.

The people who build real wealth aren’t fearless. They’re fluent in risk.

They know that comes with it, and they’ve trained themselves to move forward anyway.

And how do you get there?

Education.

Because fear thrives in the absence of understanding. Because we fear what we do not understand. And because knowledge calms the nervous system.

Discomfort is the price of growth.

When you understand how risk actually works, fear loses its grip. Emotion steps back. Clarity fills in.

That’s the magical shift: from scared money to smart money.

Because scared money locks you in. Smart money sets you free.

“Because fear thrives in the absence of understanding. Because we fear what we do not understand. And because knowledge calms the nervous system.”

Once we understand this statement above, we can change so much for the better. With money and life in general, once you’re willing to accept that you have more learning and growing to do, and you’re willing to do it, that understanding and action will do more for your life than just letting life happen.