Popping bottles, dropping dollars

A Christmas morning splurge.

I don’t know about you, but I ended 2025 with a bang.

Yes, there was champagne involved.

There was also a $731.54 purchase I hadn’t planned to make on Christmas morning. A 30% off sale nudged me over the edge. The deal was too tempting to ignore.

I’d already been paying $125 a month for membership in this trading community since August. In my head, taking the discounted offer felt smart, even strategic.

In my gut, it still hurt. Unplanned purchases always do for me. They make me feel impulsive, even when I know I can afford them.

Spending impulsively stings more than the dollar amount on the receipt.

It feels like a crack in the structure I’ve been building, a moment when discipline slips and I break the promises I’ve made to myself.

But looking at the bigger picture, I can see the upside. Had I continued with the $125 monthly plan, I would have spent $1,500 in 2026. By taking the discounted annual plan, I’m saving $64 a month — or $768.48 this year.

These money moves are some of the trickiest to pull off, requiring foresight and a little breathing room in your budget.

The reason this impulse didn’t derail me entirely is simple: diligence.

I track my spending closely, month to month, and stick to a rough budget that accounts for the unexpected.

Most of my purchases go on a credit card so I can rack up airline points. A few essentials — like rent, gas for my vehicle and apartment, my electricity bill and my $10 monthly gym membership — are paid separately. Tracking expenses this way lets me monitor spending in real time, and each month I share my progress, for better or worse.

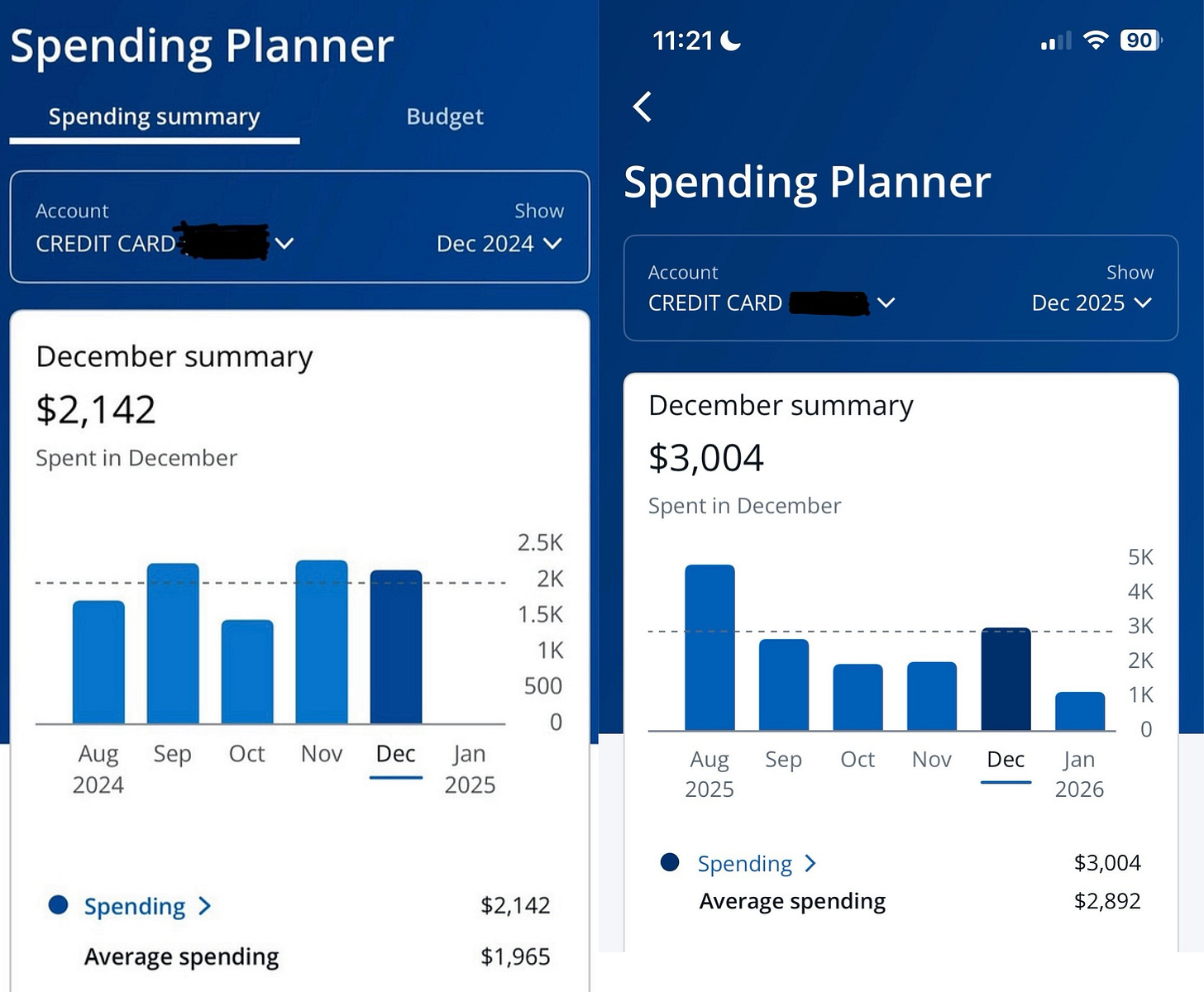

That $731.54 payment pushed my December spending past $3,000, up from just over $2,000 in December 2024.

On paper, it wasn’t the way I’d hoped to close out the year.

After hovering around $29,000 in annual spending in 2023 and 2024 (and $34,000 in 2022), I aimed to keep my 2025 spending under $25,000.

Instead, I ended the year just over $40,000.

The difference comes down to a few things: bills went up, experiences cost more, inflation nudged prices higher, and yes, a little lifestyle creep slipped in.

Through it all, my principles and priorities stayed intact.

December might be an eyesore, but my top two spending categories were education and gifts/donations. My trading membership, along with the second $500 installment to the City Mission of Cleveland, accounted for 46 percent of the month’s spending.

Because I’d been intentional with my money, I had room for both expenses without tipping the scales.

That was my 2025 in a nutshell: $40,000 spent not recklessly, but on deliberate choices, small indulgences and investments with potential to grow.

The year tested me, tempted me and tried to nudge me off course on multiple occasions.

And that final Christmas morning splurge?

The cherry on top.

And, yet, here I am — still tracking, still planning and still playing the long game.