Escape the office loop

Save time, money and energy by working from home.

I never really thought through my decision to step away from my job.

Sure, I weighed the pros and cons. I considered the work I’d be doing, the impact on my quality of life.

But I never got around to thinking about the logistics — what my day-to-day would actually look like when I no longer lived the life I had for much of the past 20 years.

For two decades, I thought I worked from home. That’s laughable. Between airports, hotels, arenas, interviews and events, I was always somewhere. Now? My entire shift is done remotely.

And I never calculated the financial ripple effects.

It’s made a huge difference.

Most days, I don’t have to leave the house if I don’t want to. That simple convenience sets off a chain reaction.

Who needs to budget for a wardrobe when you can clock in in pajamas? Those account-bleeding breakfast stops or lunch grabs? Gone. Gas? I spent only $35.75 in October. Impulse purchases and miscellaneous convenience expenses I once didn’t even notice have vanished.

It all makes you wonder why corporations and government leaders have pushed so hard for employees to return to the office. The economy lives and breathes on us, keeping that loop spinning, feeding the relentless cycle of commuting and spending time, money and energy to sustain the illusion of the American Dream.

Stepping off that ride has given me a clarity I never saw coming.

I make the majority of my purchases with a credit card so I can accrue airline points to fly for free. A few essentials — like rent, gas for my apartment and vehicle, my electricity bill and my $10 monthly gym membership — are excluded, but tracking my expenses through my credit card lets me monitor my spending in real time. Each month, I share my progress, for better or worse.

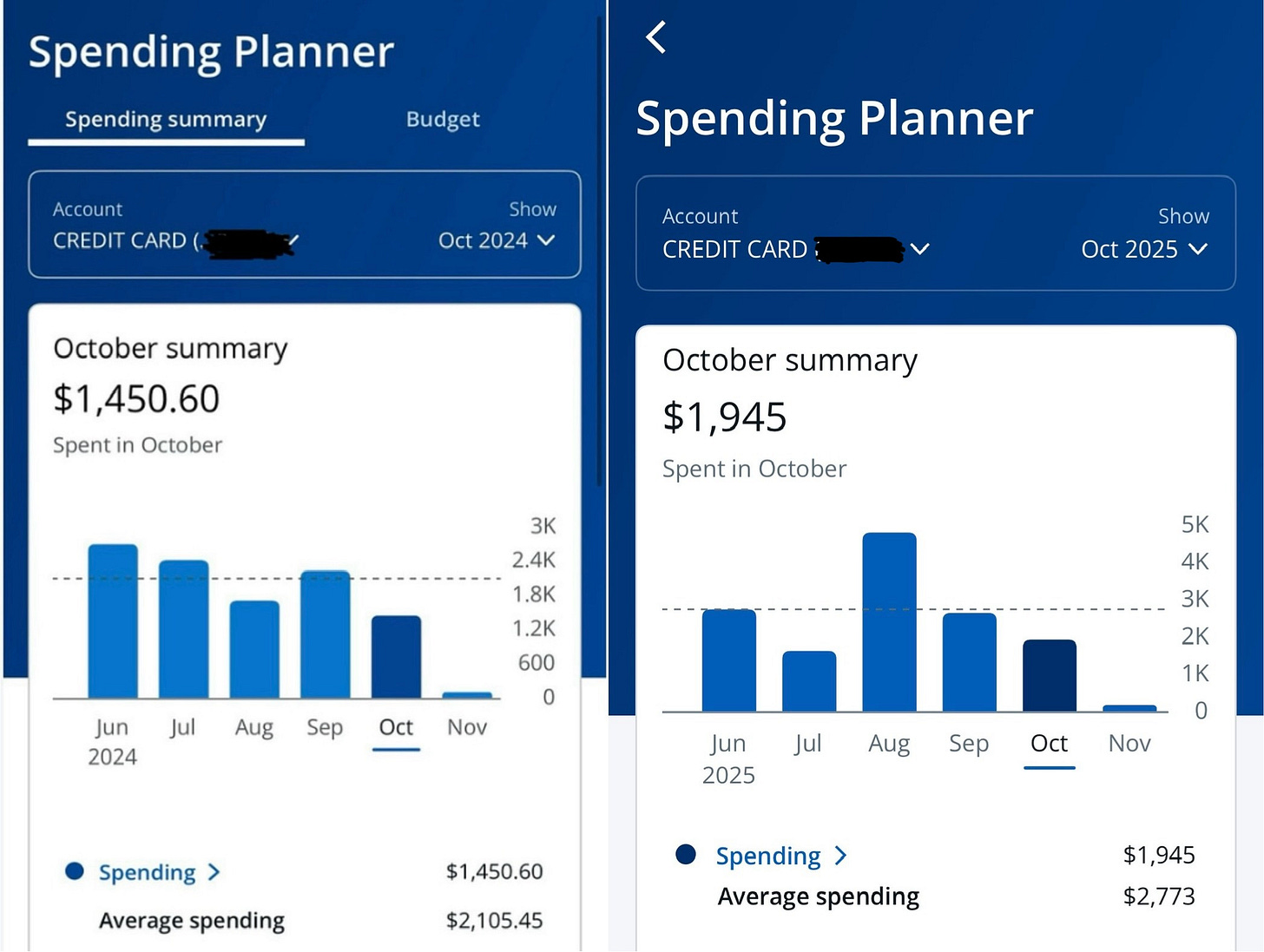

The numbers from October 2025 compared to October 2024 were revealing. I spent only about $500 more than I did last year. Without any unexpected expenses, my spending is steady, stabilizing around $2,000 each month.

I’m on pace to finish about $8,000 more than my stated $25,000 spending goal for 2025. But I’m OK with exceeding that figure. I’ve spent money more intentionally this year than I ever have. I’ve poured into myself, my business and my family. Not once have I regretted a single purchase.

Still, I was surprised to see that shopping, food and drinks made up 40 percent of my October spending. That’s not usually me, but it also reflects the growing comfort I feel as my financial plan takes root.

I can buy what I want, when I want — and it’s made easier by the fact that I don’t desire much.

It started with being deliberate about tracking every expense. I know exactly where my money goes each month, which keeps me honest and aware, even as my investments continue to work quietly behind the scenes. And despite early signs of success, I continue to live below my means, resisting the temptation to inflate my lifestyle just because I can.

That combination of diligence and restraint is the backbone of my wealth-building strategy. It keeps me moving steadily toward the life I want to create.

Breaking the daily loop created another essential layer, giving me the mental space to think, learn and act intentionally.

No more rushing to catch flights, no more $15 breakfasts on the way to meetings, no more energy spent simply showing up. With those distractions gone, I finally have the headspace to decide how I want to spend my days, my money and my energy.

My advice is simple: identify the loop that’s running your life. Then take deliberate steps to break it. The clarity, control and quiet power you gain on the other side make the effort more than worthwhile.

The wfh life isn’t too shabby at all. You like your “coworkers” most of the time and the “lunch lady” is kinda cute! 😉😂