Breaking all the rules

No guardrails. Only habits.

I haven’t budgeted in months.

I haven’t tracked a single purchase. I haven’t thought twice before swiping my card.

Most months, the first time I even look at my statements is when I sit down to write this column.

And honestly? It still feels a little odd.

I’m supposed to be a money master — a diligent, determined dollar-bill warrior. But how can I be, if I don’t even budget?

And yet, here I am, looking at my life and realizing that the rules I once thought I needed have been replaced by something stronger, steadier, more dependable.

This is what advancing to a new level feels like. Day to day, it barely registers. But in retrospect, it’s unmistakable.

I’m no longer living paycheck to paycheck. I’m no longer fearful of the next bump in the road.

Money is no longer the problem I once believed it was. The system I’ve built — through habits, discipline and consistency — runs in the background exactly as it should. Slowly, surely, abundance is beginning to arrive.

It’s been a long journey. Getting here wasn’t easy and didn’t happen overnight. I made plenty of missteps along the way. But over the past 3 1/2 years, small, repeated choices have added up.

Constraint replaced chaos. Consistency replaced calculation. Simplicity replaced spreadsheets.

I didn’t just pinch pennies or pick up extra shifts. I demanded more from myself. I chose to live differently, day after day, even when no one was watching.

I scoffed at unnecessary purchases and frivolous spending. I focused on accumulating assets rather than acquiring things that fade.

I skipped parties and nights out. In my spare time, I hit the gym, read books, binge-watched educational videos and studied the stock market.

Each small decision felt defiant, and repeated consistently, it has created something extraordinary.

I can finally — and proudly — say that I’ve graduated from trying to manage money. I’ve taken back control. Now I’m playing a new game.

Breaking the so-called rules doesn’t mean recklessness. I’m trusting the habits I’ve built, the practices I’ve honed and the vision I’ve committed to. These habits have become the framework of my life.

I don’t require or desire much. And it turns out, few wants go a long way toward keeping spending low.

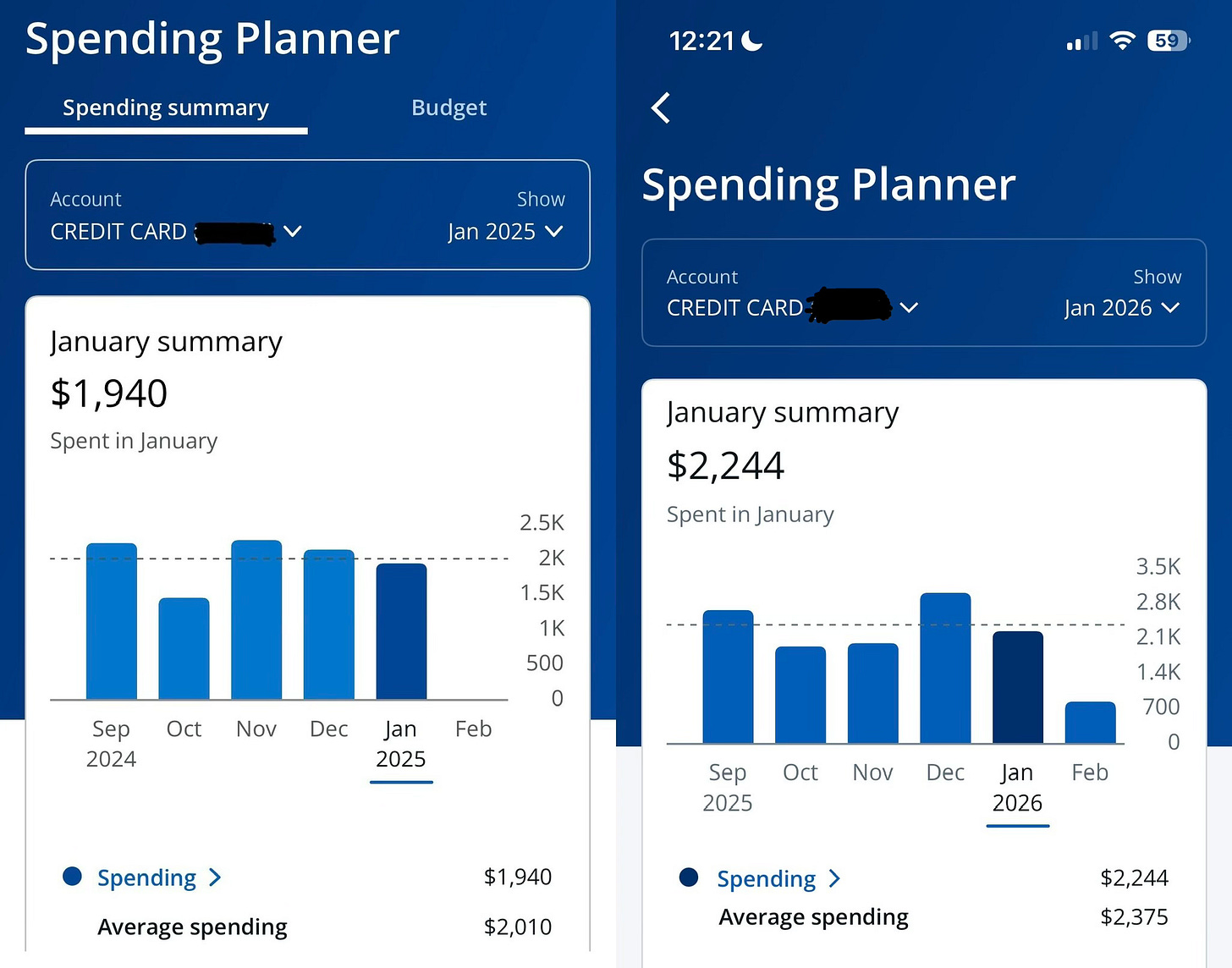

Most of my purchases go on a credit card so I can rack up airline points. A few essentials — like rent, gas for my vehicle and apartment, my electricity bill and my $10 monthly gym membership — are paid separately. Tracking expenses this way lets me monitor spending in real time, and each month I share my progress, for better or worse.

Looking back at January, the difference is just $304.

It’s small but meaningful, among the clearest signs that my habits have taken root and my system is working as it should.

That doesn’t mean I’m perfect.

My Wall Street Journal subscription auto-renewed last month at $49.99, up from the $4.99 deal I’d enjoyed throughout 2025.

I also bought two bottles of the same cologne — one of my old money pitfalls — in different sizes. Because travel sizes are necessary.

Not even those hiccups cascaded into anything more.

Most of my money flows into Bitcoin, stocks, tax-advantaged accounts and other assets now. A perfect example? My priciest purchase last month was a $622 business expense that wouldn’t have crossed my mind three years ago. Now it’s just the price of admission to a better life.

Many might feel this is all mundane, but it’s working for me. Every small, intentional choice compounds. Every action reinforces another.

I’ve never been more committed to the journey. Now it’s on my terms.

No guardrails. Only habits.

The best 'Jockeys' always break the rules of the narrative. 🛡️

In 2026, if you’re following the standard playbook, you’re just following the crowd into the Gap. Breaking the rules isn't about chaos; it's about structural advantage and outrunning the noise. Great insight, Darnell! 🏇📈