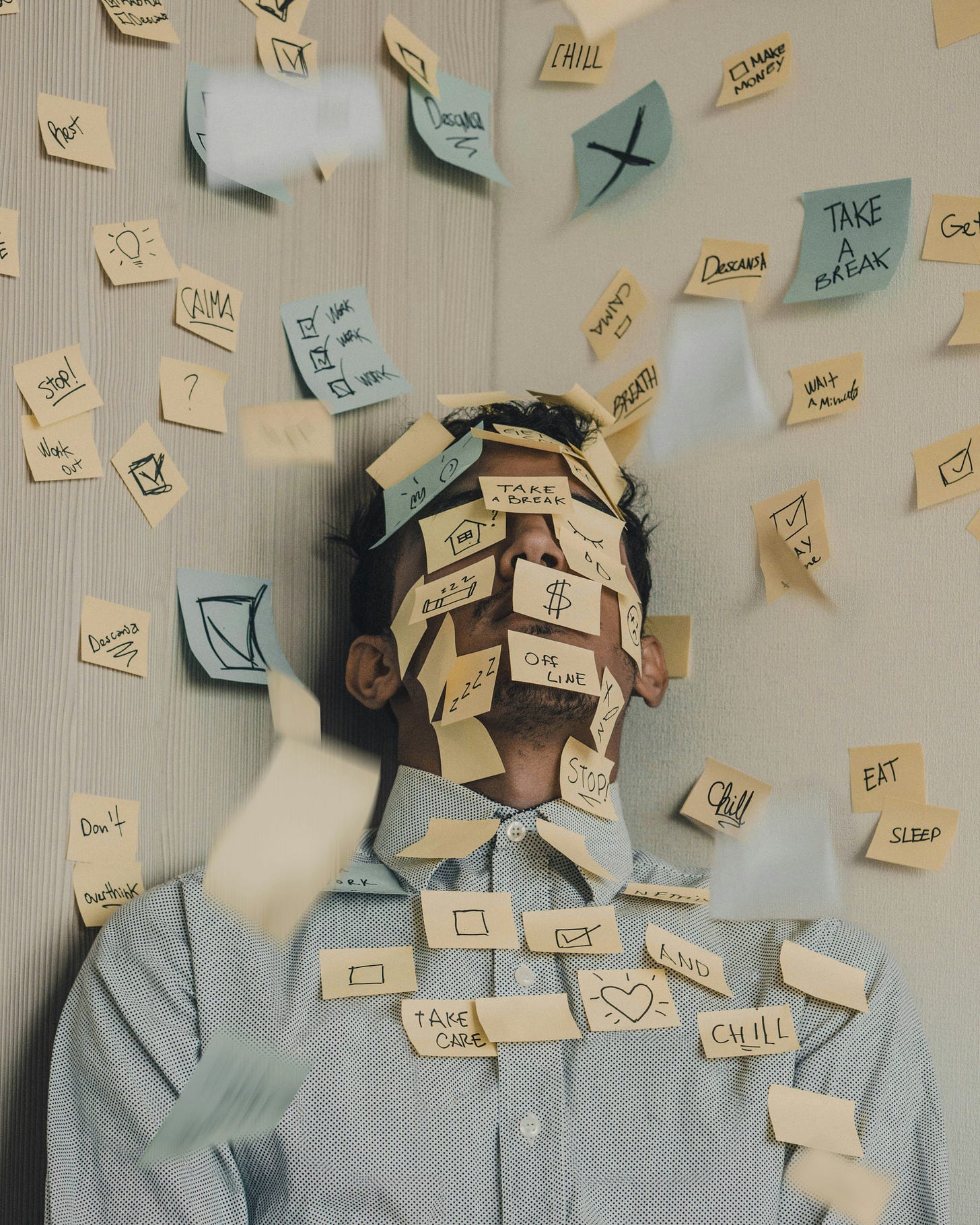

Missteps, mayhem and money mistakes

Hard-earned lessons from my investing journey.

If you’re new to Money Talks, welcome! We’re glad you’re here.

Whether you’re just starting your financial journey, or you’re looking to sharpen your existing knowledge, you’re in the right place — and in good company.

For over two years, I’ve been documenting my investing journey, not as an expert but as someone learning through trial and error. I’ve made costly mistakes, chased the wrong trends, second-guessed solid decisions and learned some tough lessons along the way.

Each week, I share my wins, losses and everything in between, so you can learn from my experiences and, hopefully, avoid the same missteps I’ve made.

So whether you’re a seasoned investor or just getting started, I hope these lessons will save you time, money and a lot of frustration.

💸 Inaction/inactivity: Failing to take action and letting opportunities slip by can be just as costly as making the wrong moves. I learned this the hard way. Fear, procrastination and overthinking kept me on the sidelines while the market kept moving.

💸 Timing the market: I spent too much time trying to predict the perfect moment to buy or sell, only to end up with more misses than hits. In hindsight, consistency would have served me far better than chasing the “right time.”

💸 Not dollar-cost averaging: Skipping a regular investing schedule left me reacting to the market instead of sticking to a plan. Dollar-cost averaging brings peace of mind during volatility and helps avoid emotional, poorly timed decisions.

💸 Stock picking: Chasing hype stocks and betting on the wrong companies cost me more than I’d like to admit. Picking winners isn’t easy — and it’s rarely consistent. I’ve learned that a diversified portfolio is a far safer (and saner) long-term strategy.

💸 Listening to outside noise: Getting caught up in headlines, hype and bad advice steered me off course more than once. I would’ve been better off tuning it out and doing my own research from the start.

💸 Not having a freedom/emergency fund: I learned quickly that without a cash cushion, even small setbacks can feel like major crises. Whether it’s a surprise expense or a market dip, having a fund gives you breathing room — and options.

💸 Consumed with consumerism: I used to spend freely on everything — from dating and dining out to subscriptions and sports — without a second thought. It left me with little to invest. While chasing the next purchase brought fleeting satisfaction, it pushed my long-term goals further away. Shifting my focus from spending to saving changed everything.

💸 Neglecting tax-advantaged accounts: Ignoring accounts like IRAs and 401(k)s means missing out on crucial tax benefits that can accelerate wealth-building. Prioritizing these accounts is one of the most efficient ways to grow your money while minimizing taxes.

💸 Not increasing income: Relying on just one income stream won’t get you far. To build lasting wealth, focus on increasing your earning potential, whether through side hustles, career advancements or developing new skills.

💸 Not maintaining sufficient cash reserves: Without extra cash on hand, I missed out on opportunities when the market dipped. Liquidity isn’t just for emergencies — it’s what lets you strike when the time is right.

Hey Darnell, have you checked out $HIMS? Could be a nice compounded, think it has 25% CAGR potential