Friday's selloff didn't surprise us

We talked about dips like this.

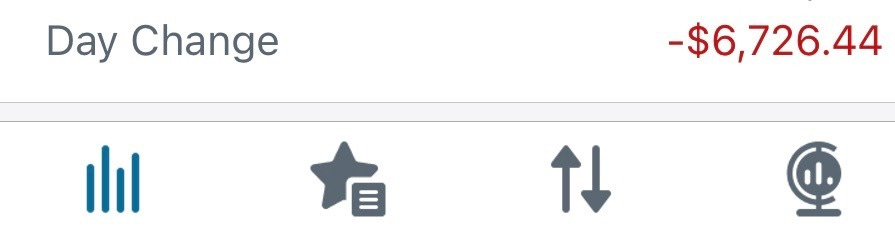

One of my accounts — the one holding my largest position — dropped $6,700 on Friday.

I saw the hit in real time. But I didn’t flinch.

We’ve talked about days like this at Money Talks. Sharp, sudden drops are part of the investing journey. They’re uncomfortable, sure, but they’re not unexpected.

That’s why we prepare. When the market throws a tantrum, we don’t panic. We stay focused, stay invested and remember the bigger picture.

And we just keep buying.

Friday’s selloff was mainly sparked by rising tensions between the U.S. and China. The U.S. announced new tariffs on Chinese goods and tighter controls on certain tech exports. In response, China limited exports of rare earth materials — important for making high-tech products.

It all made investors nervous, enough to sink the market. The S&P 500 fell about 2.7 percent on Friday, one of its bigger single-day drops this year, and its largest since April.

I’m sure my balances didn’t look much different from yours. The numbers might be different, but the color was certainly the same: red.

The bigger picture?

That 2.7 percent pullback was nothing. It takes a lot more to knock us off course.

We’re still far from what experts call a correction, a dip of 10 percent or more, and even further from a bear market, which means a drop of 20 percent or more.

It’s also important to remember that the market has been running strong this year. The S&P 500 hit multiple all-time highs and, overall, it’s still up about 11.65% year to date.

September, a notoriously bearish month, even finished in positive territory, as the market just kept cranking.

These days, all it takes is a single tweet to swing the market right back to bullish.

I’m not panicking. A pullback was inevitable. But we’re still in a bull market.

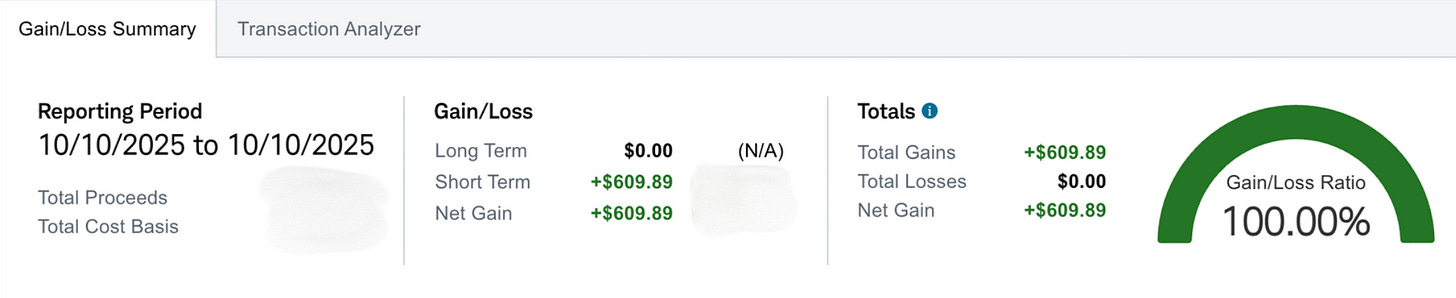

And while that unrealized $6,700 sat on my screen, my options strategy — one I’ve shared here every step of the way — locked in a $609.89 gain. Not huge by Wall Street’s standards, but meaningful for most of us.

It’s another sign we’re learning the language of the market and turning volatility into opportunity instead of fear.

I firmly believe the market will bounce back by the end of this week. In fact, by late Sunday night, it was already showing strong signs of recovery.

These short-term shocks don’t last. History shows us that after a sharp selloff, markets often rebound quickly.

So, stay calm, stay focused, and keep buying.

Because this is how long-term wealth is built — not by avoiding dips, but by leaning into them when others are panicking.

It happens. That is why they say you have to know the game you are playing. A big dip like this can be a blip or the start of a prolonged downturn. When the answer is unclear, we wait.

So interesting that I shared wit you my Crossing a Major dollar amount at 8:22am last Wednesday. Nope, I did NOT see Friday’s drop coming. However, one of my MANY take aways from MoneyTalks is not to freak out at a down turn.

The hit took me below my briefly celebrated, joyfully attained goal. I had already set a new much higher goal that I look forward to meeting soon!!

Thank you for helping me to put Gains and Losses — especially the fear of losing — the fear that kept me from investing all these years — into a rational perspective!!

Keep Talking Money!!