Parker's Roth IRA is up and running

The money move that assures my daughter future wealth.

At the tender age of 10, Parker’s financial future is secure.

Because I’ve done what I set out to do.

It took me 10 months thanks to one obstacle after another, but I got it done.

My daughter is now the owner of a funded Roth IRA. After I pick her up from school today, we’ll sit together and she’ll punch in her first investment.

It’ll be the beginning of her guaranteed road to multi-millionaire status.

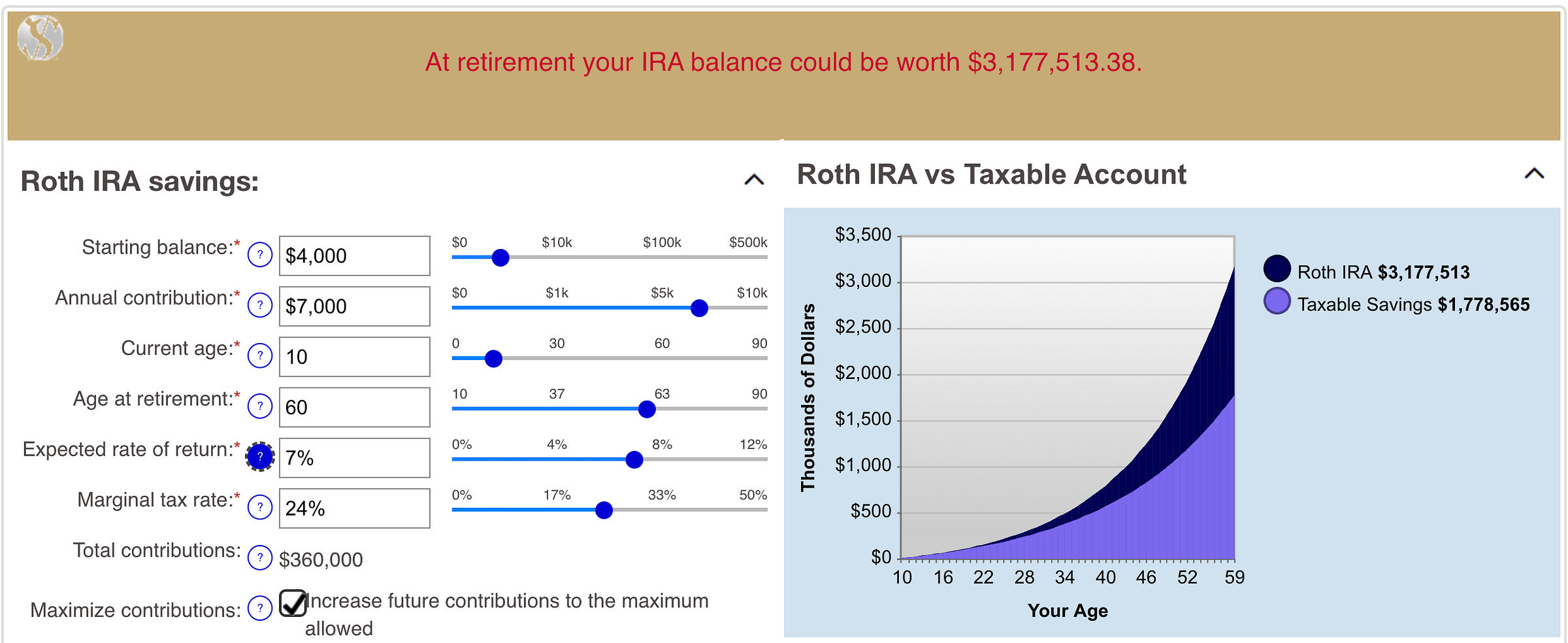

By starting with today’s $4,000 lump sum contribution, Parker’s account could be worth $3.17 million by the time she’s 60.

Fifty years might sound forever away to some and probably does to Parker more than anyone. But we plan on sticking around. We might as well build.

By putting Parker’s earnings from Money Talks into her Roth IRA, we’re jump-starting her path to wealth. It’s why I can’t stop punching in scenarios on Roth IRA calculators.

One projection showed Parker’s account crossing the million-dollar mark at 45. At 54, her Roth IRA will be $5,000 shy of $2 million. At 60, she’ll cross the $3 million threshold.

And that’s just her Roth account, with only a conservative 7% annual rate of return.

Parker’s net worth will be substantially higher when accounting for additional assets — including companies you own and operate, Parker! — she’ll amass through the years.

Her UTMA (Uniform Transfers to Minors Act) account, launched last April, has been running smoothly for the past year. She’s up 14.43% on that account and, with a $70.39 dividend payout received Wednesday, has collected $411.77 in dividends from her position in the Vanguard High Dividend Yield Index Fund ETF, ticker symbol VYM.

I’ve decided to dedicate 100% of Parker’s Roth IRA money to the Vanguard Total World Stock Index Fund ETF, ticker symbol VT. The fund is made up of about 60% domestic stocks and roughly 40% emerging markets.

I settled on this index fund for its broad balance, low expense ratio and international exposure given that much can change in the global economy over Parker’s investing horizon. Sure, I’ll always bet on America. But I’m hedging that bet by also betting on the best and brightest companies from around the world.

A tax professional told me last December that the IRS might not look favorably on the proceeds from Money Talks being split 50-50 with Parker since she isn’t responsible for 50% of the workload. The information initially made me think it wouldn’t be possible to max out Parker’s Roth IRA.

But then I learned that I can contribute gifts.

As long as Parker maintains income as a partner at Money Talks (or any other job she works), I can match up to the contribution limit. So if she made $4,000 for her role at Money Talks in 2023, I can give her $2,500 as a gift to max out her contribution.

The strategy makes me think back to the wealth multiplier for young savers chart posted to Parker’s bedroom wall. We added it to her “money wall” to remind Parker how powerful a journey she’s on simply by starting early and, hopefully, seeing investing through.

But before I could begin to taste financial freedom for Parker, I needed to overcome virtually every hurdle imaginable.

First, I hit a snag with Parker’s social security card. Because I don’t have a physical copy, associates at one Bank of America branch last October prohibited me from opening an account dedicated to Parker, with me as a joint owner.

I tried and failed with Chase. I thought I cracked the code with Alliant Credit Union in early February only to be told, after three weeks of waiting and submitting multiple applications, that Parker apparently already has an Alliant account. Then I went to Capital One…Success!

I opened a Capital One Money teen checking account on March 4. The company markets the account as one for teens but acknowledges younger children are welcome as well.

I linked Parker’s new checking account to her brokerage on March 5.

One week later, I made Parker the first person paid from Money Talks!

All payments we’ve received since partnering with Advance Ohio last May had been sitting in our business checking account. I hadn’t moved a penny. I simply watched the account swell. It’s accrued only $72.41 on less than a 2% interest rate, so it clearly wasn’t parked there for maximum growth.

As a budding solopreneur, I was too terrified to touch it. If you think you’re a stickler, Parker, wait until you get a load of our annoying Uncle Sam.

It was important to me to do everything I could properly, lining up the paperwork as best I could. That meant securing Parker a checking account she owns so I could make transfers from our business checking directly to her before funneling from there to her Roth.

On March 12, I made Parker’s first $2,500 transfer from our business checking account to her checking account. I planned to inform her as a surprise after school last Thursday only to hit another snag.

Parker caught strep throat. Our weekend was delayed.

On Tuesday, I moved another $1,550 from our business account to Parker’s, intentionally to leave $50 in her checking. All that’s left is counting down to today’s dismissal at 2:50 p.m.

When Parker hops in the car today and begins reading this column, I’ll be in the front seat beaming on the way home. Shining brighter than a diamond. One proud papa.

Finally, I’ve paid Parker what I owe her.

With today’s first investment, Parker will take another step toward an abundant life.

This will help her to never worry about money. It puts her on a path to never having to live paycheck to paycheck. It provides security that will allow her to never work a job she doesn’t find fulfilling.

My only concern is that we’re jumping in while the market is at all-time highs. Parker’s fund, ticker symbol VT, hit its 52-week high Wednesday, topping $110 per share.

But the kid’s got a 90-year time horizon. She’ll be fine.

The first few years could be choppy as market corrections arrive. Dips will turn her account red more than we’d care for. But we’re building our tolerance, and we’ll never stop buying.

You will change the trajectory of our family when you press that order button today, Parker. And I’ll be at peace knowing I’ve done everything to fulfill my highest duty as your father.

For this is the legacy I’m leaving you.

Disclaimer: The information contained on Money Talks is not intended as, and should not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor. These are my personal experiences, and neither this website, newsletter nor podcast is a substitute for advice from a qualified professional.

I believe you are making a serious mistake when you state "As long as Parker maintains income as a partner at Money Talks (or any other job she works), I can match up to the contribution limit. So if she made $4,000 for her role at Money Talks in 2023, I can give her $2,500 as a gift to max out her contribution." It is true that the IRS does not particularly care where the money comes from for Roth IRA contributions (since it is after-tax money after all), but the fact is that the TOTAL combined contribution to her Roth IRA from you (as a gift) and her cannot exceed the earned income that she received for the year. So, if she made $4000 in 2023, then the TOTAL maximum contribution to the Roth IRA can only be $4000, not $4000 from her and $2500 from you as a gift. The penalties from making excess contributions can be severe.

Way to go, Darnell!! Congratulations, Parker!! Keep up the good work “Team Mayberry.”